Forum

- Home

- Forum

It's been a while since I did a countdown diary - almost 4 months (see the full list at the end of the diary), and the impertinent amongst you might point out to the essentially flat oil prices over the past 2 years as proof that I was scaremongering all along ... or simply wrong, and that my silence was simply reflecting my belated acknowledgement of reality...

But the quarterly results of the big oil companies have provided me with some new data:

* Jerome a Paris's diary :: ::

*Production (mboe/d) ExxonMobil Shell BP Chevron Total ConocoPhillips

Q1 2006 4.56 3.75 4.04 2.64 2.44 2.09

Q1 2007 4.44 3.51 3.91 2.64 2.43 2.01That table tells us that none of the big oil companies has been able to increase its oil production over the past year - in fact, most have seen a decline in their production.

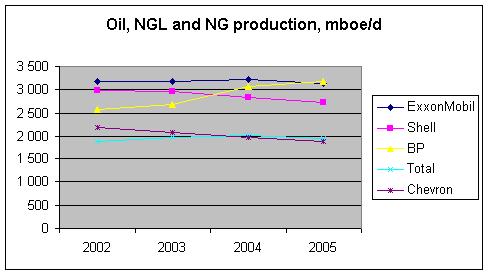

And, in fact, this is not a temporary blip: oil production for these companies has been flat or declining over the past 5 years:

The only company to enjoy a significant production increase is BP, and that was linked to the increase in the production in its 50% owned Russian subsidiary, TNK-BP, which has now also stalled.

So we have an incontestable trend here: Big Oil is unable to increase its oil&gas production. And this, after almost 8 years of almost non stop oil price increases:

What's going on? Aren't markets working? A price increase, especially such a longlasting and massive one, should be a signal to producers to produce more, and to consumers to consume less. As we know, consumers are burning more oil thanks to record economic growth in China and elsewhere, and demand appears to not be very sensitive to prices in both emerging economies and oil producing countries as the good times roll. Despite flatter consumption growth in the developed world, demand is going up overall, and drives prices up.

But supply should then have delivered. And indeed it has, as spare production capacity around the world has been put in service. But new capacity, in particular that developed by the oil majors, should have followed. And yet we see from the above numbers that it hasn't. Again, BigOil has been unable to increase production in the past 5 years.

One thing is obvious - it's not for lack of money. The companies are enjoying record income and profits, thanks precisely to those high oil prices. It's just that this money has been used to a much larger extent to buy back shares (effectively handing the money back to shareholders) than to invest in oil&gas production.

BigOil is effectively telling the market that it thinks its shareholders can use their money more profitably in other sectors of the economy.

Despite the significant increases in their costs (everything has gone up: raw materials, rigs, qualified personnel, as well as tax rates in oil producing countries), the profits from those assets they have put in production are high enough to suggest that oil companies would invest if they could.

Thus it means that they can't. Quite simply, they no longer have access to new reserves.

Many articles in the MSM lately have criticized oil producing countries for not opening their reserves to foreign investors, as well as for not investing enough themselves, via their national oil companies. Whether this is caused by incompetence, short-sighted politics (governments limiting investment to grab the cash), long term strategy (hoarding while enjoying the higher prices on current production) or geopolitical posturing (the "energy weapon"), or, as is likely, a combination of all of these, is fundamentally irrelevant.

What matters is that we have effectively lost control of oil supply (and by "we", I mean Western oil companies whose goal is to bring as much oil as possible to the market to fulfill existing demand).

And that's a pretty fucking big deal.

The good news, of course, is that there is something within our control: our demand. Lowering our demand would mean needing less supply and lower prices, all thing equal. and as we all know, a lot could be done on that front. The bad news, of course, is that our leaders are mostly oblivious to the issue, focusing exclusively on finding new or alternative sources of oil or energy (whether the highly problematic coal-to-liquids, the insane rush towards biofuels, the dirty oil sands in Canada, etc...).

Lest you think that I consider Europeans more enlightened in this respect, let me disabuse you with the following paragraph, which is the full extent to which a summary report (pdf, in French) about the energy prospects of France to 2050 (by the Center for Strategic Analysis of the French government, an influential body full of insiders and knowledgeable experts) talks about "peak oil".

La question de la date et des circonstances dans lesquelles la production de produits pétroliers connaîtra, soit un maximum avant de commencer sa décroissance ("peak oil"), soit plus probablement un "plateau", reste controversée. En bonne logique économique, c'est la réduction de la demande de produits pétroliers dans les pays les plus développés, imposée par la maîtrise du risque climatique, qui devrait en être le fait générateur.

Mais il n'est nullement exclu, surtout si ces politiques tardent à se mettre en place, que ce soit le comportement des pays producteurs qui, par volonté délibérée ou par insuffisance d'investissement, constitue le goulet d'étranglement conduisant à une telle situation. Rappelons à nouveau, enfin, qu'une crise a priori sans rapport avec les réserves et leur exploitation peut créer un tel goulet (menace terroriste, évolution du marché de l'assurance, évolution du transport maritime,...) et que ces crises, dont la survenance est certaine, sont quasi imprévisibles dans leur origine et parfois dans leurs conséquences...

The question of the date and circumstances under which oil production will reach a maximum before decreasing ("peak oil") or, as is more likely, will plateau, remains a controversial subject. In good economic logic, it is the reduction of demand for oil products in developed countries (linked to policies focused on climate change risk) which should be the cause of such event.

However, it is quite possible, especially if such climate change policies are delayed, that it is the behavior of oil producing countries (whether by deliberate policy, or by lack of investment) that will create the bottleneck that brings about such circumstances. Let's note as well that a crisis unrelated to oil reserves and their extraction (terrorist threats, changes in the insurance market, change in maritime transport) could cause a similar scenario and that such crises, whose occurrence is certain, are almost totally unpredictable, as are their likely consequences.

The report focuses to a large extent on climate change and its consequences, which is nice to note, but a strategic analysis of energy issues which dismisses peak oil as something uncertain and about which nothing can be done anyway appears, somehow, ... weak - and terrifying, because it means we won't be ready for it. And that's coming from a literal "who's who" of the energy industry in France, and is meant to shape governmental policy. It's quite pathetic, frankly.

Thus we have highly worrying underlying trends as to oil production and the extent to which it functions according to 'our' rules (i.e. profit driven), and largely clueless governments.

So why have prices remained so low?

The question might be put the other way, in fact. Considering that we've had an incredibly warm winter, which has significantly dulled winter demand, how come prices never really went down? As some of you have noted, gasoline prices are already quite high, early in the 'driving season'. With drivers in the West already used to - and increasingly comfortable with - current price levels, and with demand continuing to sky rocket in China, Iran, Saudi Arabia, Russia, India, prices can only go one way.

And BigOil can cash in to some extent, but they are effectively no longer a decisive player.

The average kwan is of such low quality that he'd shoot himself if he had any self awareness.

-Joe from Ohio